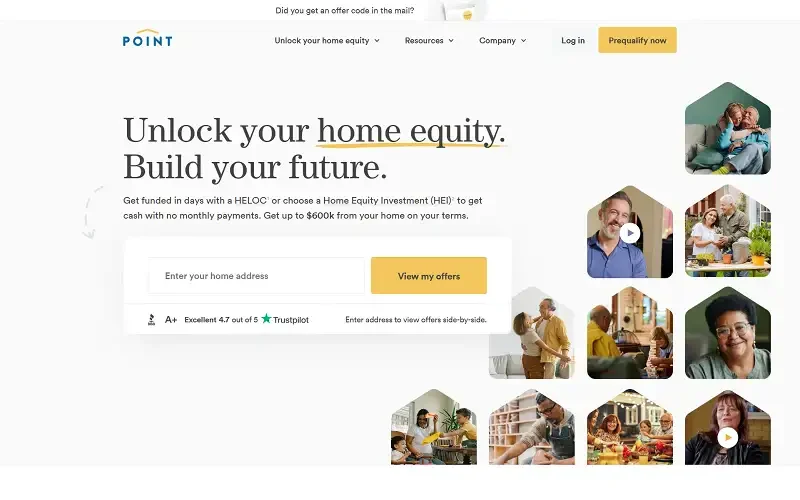

For many homeowners, a large portion of their wealth is tied up in their home’s equity. Yet traditional options to access that equity—such as home equity loans and HELOCs—often come with monthly payments, interest, or complex qualification requirements. That’s where Point Digital Finance steps in: a fintech company offering a new way to unlock home equity by sharing future appreciation instead of burdening you with debt.

If you’re a homeowner who wants to tap into your home’s value without adding monthly payments or interest, Point offers a compelling alternative.

What Is Point Digital Finance?

Point Digital Finance is a U.S.-based fintech company (founded around 2015 and headquartered in Palo Alto, California) that provides “home equity investment” (HEI) products — allowing homeowners to receive a lump-sum in exchange for a share of their home’s future appreciation, rather than taking out a typical loan.

Rather than borrowing and paying interest, you enter into a partnership: you get cash now; Point gets a share of your home’s appreciation later when you sell, refinance, or at the end of the term.

Key Features of Point

Here are several standout features that make Point interesting:

- No monthly payments & no interest: Because it’s not a traditional loan, you don’t make monthly payments; you pay back based on home price appreciation.

- Access to home equity: Homeowners can unlock cash (often tens to hundreds of thousands) for purposes like home improvements, debt elimination, investing or other goals.

- Shared-equity structure: Point invests in a portion of your home value now in exchange for a portion of future gains — aligning their interests with yours.

- Alternative to HELOCs and loans: Designed for homeowners who want equity access but don’t want new monthly debt obligations.

- Digital experience: Application, valuation and onboarding are largely online, making the process more convenient for many users.

How Point Works

Here’s a simplified workflow of how a homeowner might use Point:

- Apply online: Begin with a digital application and estimate of your home’s value.

- Valuation & offer: Point performs a home appraisal and makes an offer for the equity share.

- Receive cash: If you accept, you receive cash without monthly loan payments or interest.

- Term & exit: At a defined point (e.g., when you sell or refinance, or after a certain term) you pay Point based on the home’s value at that time.

- Home value movement matters: If the home appreciates, you pay more; if it declines or stays flat, you pay less in appreciation terms — though you still repay the principal investment.

Why Homeowners Choose Point

Homeowners might opt for Point when they:

- Want liquidity from their home equity but don’t want monthly debt.

- Have high-interest debt they’d like to pay off, or want to invest, renovate, or diversify.

- Prefer alignment of interests: since Point’s return depends on your home appreciating, your goals align more.

- Value a digital, streamlined process compared to traditional lenders.

- Want an alternative when other equity options (HELOC, second mortgage) may not suit their situation.

Pros and Cons of Point

Pros:

- Avoids monthly payments and interest in the traditional sense — frees up cash flow.

- Provides access to home equity without borrowing in the usual way.

- Shared-equity structure aligns homeowner and investor interests.

- Useful for homeowners who want to tap equity but prefer not to take on more debt.

- Digital experience may speed up process compared to traditional home equity products.

Cons:

- Because you’re sharing future upside, if your home appreciates significantly you may pay more value to Point than you would have via a standard loan.

- The share of appreciation means you’re giving up some future gain — it’s a trade-off.

Final Thoughts

If you’re a homeowner looking to unlock capital from your home without taking on monthly payments or extra interest, then Point Digital Finance offers a modern alternative to traditional home equity products. It’s especially suited for those who believe their home will appreciate and want to access funds now, while sharing some of the future value in exchange.

That said, it’s definitely not one-size-fits-all — you’ll want to evaluate how long you plan to stay in the home, how your local market is expected to perform, and compare the effective cost of this structure versus traditional borrowing.

Flexible. Innovative. Home equity reimagined. That’s Point Digital Finance.

It’s time to check it out — Get Financing With Point