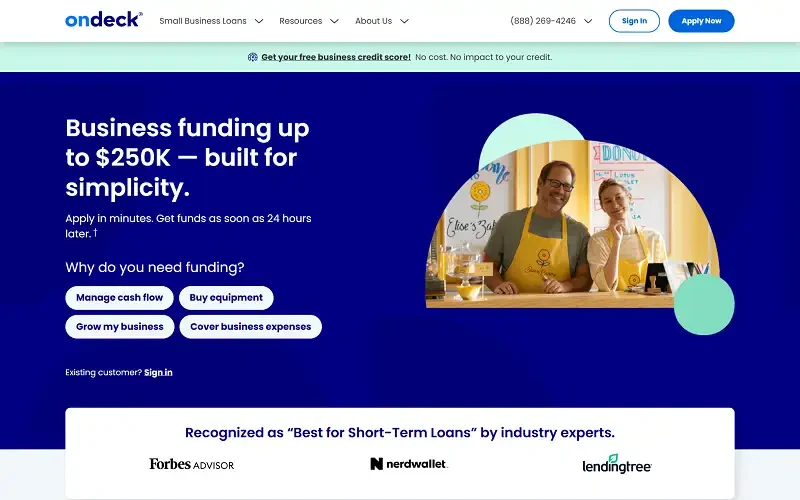

For many small businesses, cash flow is the biggest challenge. Waiting weeks for a bank loan can mean missed opportunities, delayed payroll, or stalled growth. That’s where OnDeck steps in. Known for its quick approval process and flexible lending solutions, OnDeck has become a go-to for entrepreneurs who need funding fast.

What Is OnDeck?

OnDeck is an online lender specializing in small business loans. Founded in 2006, the company set out to change the way small businesses access capital. Instead of the slow, paperwork-heavy process of traditional banks, OnDeck uses advanced technology and data to approve loans in as little as 24 hours.

This focus on speed and accessibility has made it especially popular among business owners who don’t qualify for conventional bank financing.

Loan Options Offered by OnDeck

OnDeck offers two main types of loans designed to meet different business needs:

- Term Loans – Lump-sum financing up to $250,000, with repayment terms from 18 to 24 months.

- Business Lines of Credit – Flexible borrowing up to $100,000, where businesses draw funds as needed.

These options give small business owners a choice between one-time funding for major expenses or ongoing credit for day-to-day operations.

Eligibility Requirements

Not every business qualifies for OnDeck loans, but the criteria are simpler than traditional banks:

- Minimum business operating time: 1 year (some exceptions for strong credit).

- Minimum annual revenue: $100,000.

- Minimum personal credit score: Typically 600+.

- U.S.-based businesses only.

These requirements make OnDeck accessible to startups and small companies that may not meet strict bank standards.

How to Apply / Application Process

OnDeck’s application process is designed to be fast and straightforward:

- Fill out a short online form with business and personal information.

- Submit basic financial documents like bank statements and tax returns.

- Receive a loan decision, often within 24 hours.

- Fund the approved loan directly into your business account.

The entire process can often be completed without ever visiting a bank branch, which is ideal for busy business owners.

Why Businesses Choose OnDeck

Businesses choose OnDeck because it delivers fast, reliable funding without the cumbersome requirements of traditional banks. Entrepreneurs often rely on OnDeck when unexpected expenses arise, opportunities require immediate capital, or conventional lenders turn them down. The platform’s streamlined digital application, rapid approval process, and flexible loan options make it especially appealing to small business owners who need money quickly to keep operations running smoothly. Additionally, OnDeck reports to business credit bureaus, allowing companies to build their credit history for future financing opportunities.

Pros and Cons of OnDeck

Pros:

- Fast funding—often within 24 hours.

- Simple online application process.

- Options for both term loans and lines of credit.

- Helps businesses build credit by reporting to major bureaus.

- Available to businesses with lower credit scores than banks usually accept.

Cons:

- Higher interest rates compared to traditional bank loans.

- Daily or weekly repayment schedules can strain cash flow.

- Best suited for short-term financing, not long-term growth capital.

Final Thoughts

OnDeck isn’t designed to replace traditional banks—it’s built to fill the gap they often leave behind. For small businesses that value speed, convenience, and flexibility, OnDeck can be a lifeline. While the cost of borrowing may be higher, the trade-off is quick access to funds that can keep a business running or even help it grow.

For entrepreneurs who can’t afford to wait, OnDeck proves that sometimes speed is the greatest advantage.