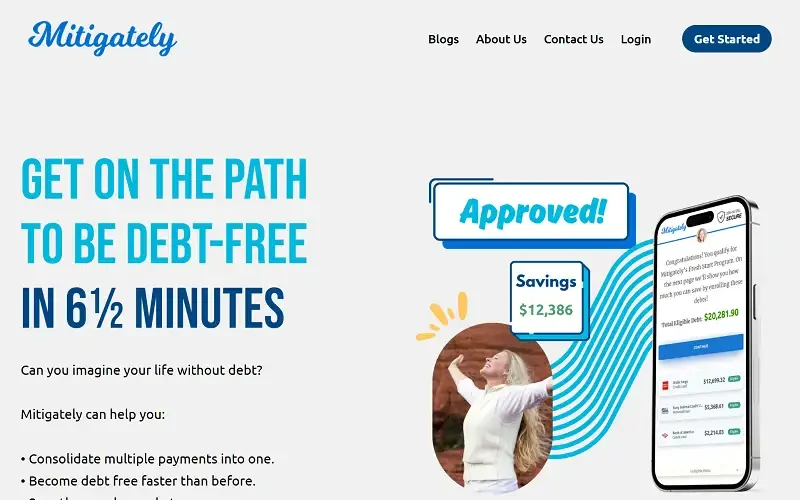

Debt can feel overwhelming: multiple cards, high interest rates, bills stacking up, and no clear path forward. Mitigately aims to change that. By combining digital speed with personalized debt-relief strategies, Mitigately helps people reduce burdens, simplify payments, and regain financial control.

An Overview of Mitigately

Mitigately is a U.S.-based fintech focused on debt consolidation and relief. They’ve developed an AI-driven agent that matches individuals with optimal debt solutions in minutes.

With a promise of “free until accounts settle”, Mitigately positions itself as a modern alternative to traditional debt-program providers.

What Mitigately Offers

When you engage with Mitigately, you’ll likely encounter:

- A quick online intake process (average ~6.5 minutes according to their site) to identify debt-relief possibilities.

- Options to consolidate multiple unsecured debts (credit cards, personal loans, medical bills) into one payment or plan.

- AI-matching of users to tailored programs: consolidation, negotiation, or settlement.

- Free service until the debt is settled (they claim).

- Reports of significant savings: average 35% reduction cited, with higher in some cases.

How Mitigately Works

Here’s a simplified flow:

- Submit Details – Enter your debt amounts, types (credit card, personal loan, etc.), and financial situation.

- AI-Match – Their system identifies the best fit program for you: consolidation loan, settlement, or structured pay-down.

- Enroll in Solution – You choose a plan, sign up, and Mitigately coordinates with creditors (or loan originator) as applicable.

- Execute & Monitor – You follow the plan, make payments, and move toward debt-freedom; Mitigately monitors progress and handles creditor communication.

Why People Choose Mitigately

Many choose Mitigately because it offers:

- Speed – The digital, AI-driven process is faster than many traditional debt relief programs.

- Simplification – One payment instead of many, fewer creditor contacts, and a cleaner path.

- Savings – The potential for reduced interest, fewer payments, and improved cash flow.

- Accessibility – People with less-than-perfect credit or complex debt loads can often find a plan.

Pros and Cons of Mitigately

Pros:

- Fast digital intake and matching (minutes instead of weeks).

- Potential for significant savings and payment reduction.

- One-stop solution for multiple debts and creditor coordination.

- Transparent claim of “free until settlement”—reduces upfront cost-risk.

- Positive user testimonials and strong online ratings.

Cons:

- Debt relief can still impact credit score (as with all settlement/consolidation).

- Terms may depend heavily on personal debt profile and creditor cooperation.

- As with many fintech debt solutions, success depends on user follow-through.

Final Thoughts

Debt relief doesn’t have to mean endless calls, paperwork, or months of confusion. Mitigately brings speed, clarity, and actionable plans to a space that many find daunting.

If you’re facing multiple high-interest obligations and want a streamlined, digital path to consolidation or settlement, Mitigately is a solid contender. As always, be sure to review the plan details, understand how it impacts your credit, and ensure you can commit to the payment structure.

Digital. Fast. Relief-oriented. That’s Mitigately.

It’s time to check it out — Get Mitigately Now