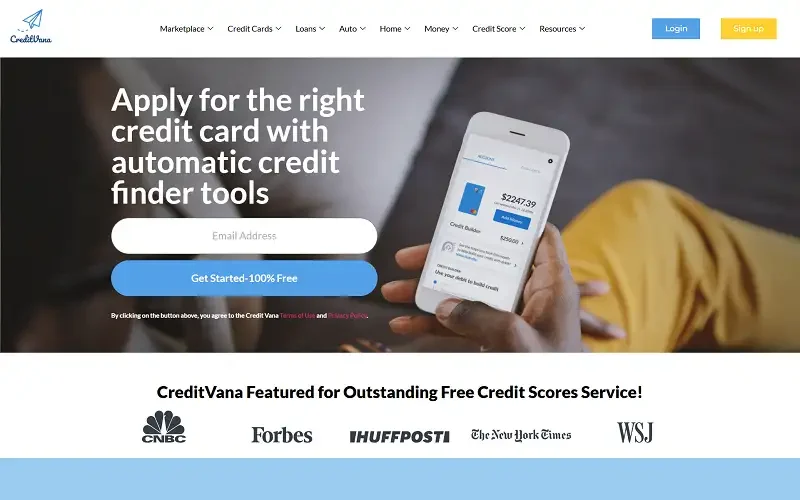

For many individuals, building or improving credit feels opaque, confusing, and expensive. Traditional credit products often require high scores, extensive history, or hefty fees. Enter CreditVana — a platform aiming to make credit monitoring and credit-building more accessible, transparent, and integrated into everyday financial habits.

With CreditVana, you get more than just a credit score snapshot — the idea is to use monitoring, reporting, and tailored tools to help improve your credit profile while you manage money smarter.

What Is CreditVana?

CreditVana is a U.S.-based fintech platform that offers credit monitoring, a virtual secured credit-builder product, banking-style tools, and integrated financial tracking.

Key highlights:

- Free credit score monitoring and reports (using Experian® data) included.

- A virtual secured credit card option tied to a debit-style account for building credit history (reported to major bureaus) — described by their site as “Credit Builder”.

- Banking tools: FDIC-insured accounts, savings options, and tracking of spending/credit behaviour.

The mission: help users understand, track, and improve their credit — not just for when they apply for a loan, but as part of daily financial health.

Key Features of CreditVana

Here are the standout features that users will appreciate:

- Free credit‐score checks & monitoring: Instant access to your credit score and report card via the app.

- Credit-Builder virtual secured card: Enables users to build payment history without taking on unsecured debt.

- Banking & savings tools: Earn interest (4.81% APY on certain balances, per their site) and manage savings alongside credit goals.

- Dashboard of financial-health metrics: Track spending habits, credit report factors, savings goals and more.

- No or low fees (depending on plan): The product emphasizes minimal monthly fees for the credit-building tool.

How CreditVana Works

Here’s a simplified user journey:

- Sign up via the mobile app or web: you enter personal info and link desired banking or savings features.

- Access your free credit score/monitoring immediately through the dashboard.

- Opt into the Credit Builder product (if eligible) — you’ll fund a secured account or card, make monthly payments, and those are reported to credit bureaus.

- Use the banking & savings tools: allocate funds, earn interest, track spending, and view how your habits affect credit.

- Monitor progress: check dashboards for improvements in score, payment history, savings growth, and adjust behaviours accordingly.

- Repeat & scale: As you build positive credit behaviour, consider higher tiers or additional credit-building tools available on the platform.

Why Someone Might Choose CreditVana

CreditVana appeals for several reasons:

- If you have limited or no credit history, it gives you a path to build history via a secured virtual card rather than high-risk traditional credit.

- If you want transparent credit monitoring (not just “credit score up” but actual tools to improve your profile).

- If you appreciate integrated banking + credit tools in one place (savings, card, credit builder) rather than managing separate apps.

- If you’re seeking affordability: fewer hidden fees, clear terms, and a secured option without a massive deposit.

- For those who prefer a mobile-first and modern fintech approach, giving more control and visibility over what affects credit.

Pros and Cons of CreditVana

Pros:

- Offers free credit score and monitoring via the app.

- Virtual secured credit-builder card reported to major bureaus — helps build payment history.

- Integrated savings/banking tools alongside credit features.

- Transparent, mobile-friendly platform designed for accessibility.

- Good entry path for those underserved by traditional credit systems.

Cons:

- Credit score improvement is not guaranteed — it depends on consistent payment behaviour and other credit factors.

- Only suitable for certain credit-builder goals; may not replace full credit lines or large loans.

Final Thoughts

CreditVana offers a compelling option for anyone looking to take control of their credit and financial health — especially if you’re either starting fresh or rebuilding. By combining credit monitoring, a secured build-credit path, and banking tools in one platform, the service presents a modern alternative to piecemeal credit and banking products.

If you’re committed to making consistent on-time payments, monitoring your credit behaviour, and leveraging savings alongside credit building — CreditVana could be a smart step. Just be sure to review the terms, check eligibility, and understand that building credit still requires routine and discipline.

Accessible. Transparent. Credit-building with purpose. That’s CreditVana.

Now just take a look — Get CreditVana Now