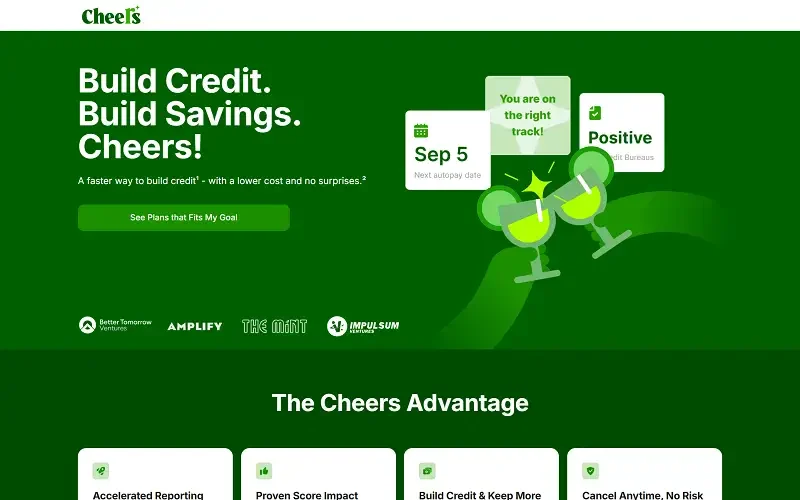

In the modern economy, one of the toughest barriers for many people is not just access to credit — it’s building a credit profile in the first place. That’s where Cheers Financial Inc. comes in. Designed to serve individuals often overlooked by traditional credit systems — such as immigrants and gig workers — Cheers aims to open doors through a fresh take on credit-building.

With its automated approach and transparent structure, Cheers offers a new path to financial inclusion, letting users build credit, report to bureaus, and take control of their financial future.

What Is Cheers Financial?

Cheers Financial Inc. is a U.S.-based fintech company focused on credit-building products and services. According to its own description, it automates credit-building for millions of Americans, with a focus on populations that face credit access challenges.

Despite being a relatively small company (headcount listed as 1-10 on Crunchbase) it marks itself as a mission-driven provider in the credit space.

Key Features of Cheers

These are some of the features and benefits that distinguish Cheers:

- Credit-Builder Product – Users are able to build credit, with reporting to all three major credit bureaus.

- No Hidden Monthly Fees – Cheers claims minimal or no administrative fees for their core product.

- FDIC-Insured Funds – While Cheers is a fintech (not a bank), its funds are held with a partner bank (Sunrise Banks N.A.) and thus FDIC insured up to relevant limits.

- Targeted User Base – Particularly oriented toward immigrants and credit-invisible populations who want to establish or rebuild credit.

- Mobile-First Experience – Everything from onboarding to management is designed to work via mobile or browser, simplifying access.

How Cheers Works

Here’s a basic walkthrough of the user journey with Cheers:

- Sign Up – The user provides information, often via mobile, to create an account and verify eligibility.

- Choose Coverage – The user pays or sets up the credit-builder product, which may involve deposit or periodic payment.

- Credit Reporting – Cheers reports the user’s payment behavior or product usage to the credit bureaus, helping build credit history.

- Manage & Grow – The user monitors their credit progress, uses additional guidance, and may add features/tools as needed.

The emphasis is on making credit-building accessible, transparent, and manageable, especially for those without longstanding credit history.

Why People Choose Cheers

Many users are drawn to Cheers because it addresses a gap in the market:

- They might be new to the U.S. credit system (immigrants) and need a tool to establish credit.

- They may have limited or no credit history, and want reporting without taking on large debt.

- They prefer simplicity and transparency over complex credit products.

- They want to monitor and control their credit outcome rather than being locked into opaque terms.

For these users, Cheers offers a viable alternative to traditional credit-building methods — one tailored to today’s mobile, diverse economy.

Pros and Cons of Cheers Financial

Pros:

- Focus on underserved populations and credit-invisible consumers.

- Transparent fee structure and mobile-friendly product.

- FDIC-insured partner bank backing adds trust and security.

- Reporting to major credit bureaus helps users build measurable credit.

Cons:

- As a smaller fintech, the brand may lack the scale or support infrastructure of major banks.

- Credit-builder products typically are not a replacement for full credit access, so users still may face limitations in borrowing power.

Final Thoughts

Cheers Financial stands out as a purpose-driven fintech focused on making credit building more accessible and equitable. For individuals who’ve faced barriers to traditional credit, Cheers offers a clear, mobile-friendly path to start establishing or rebuilding their credit profile.

If you’re someone looking for a simple, transparent, and supportive entry point into the credit world — especially as an immigrant, gig worker, or someone new to the U.S. credit system — Cheers could be a strong contender.

Accessible. Transparent. Empowering. That’s Cheers Financial.

It’s best to check it out — Get Cheers Now