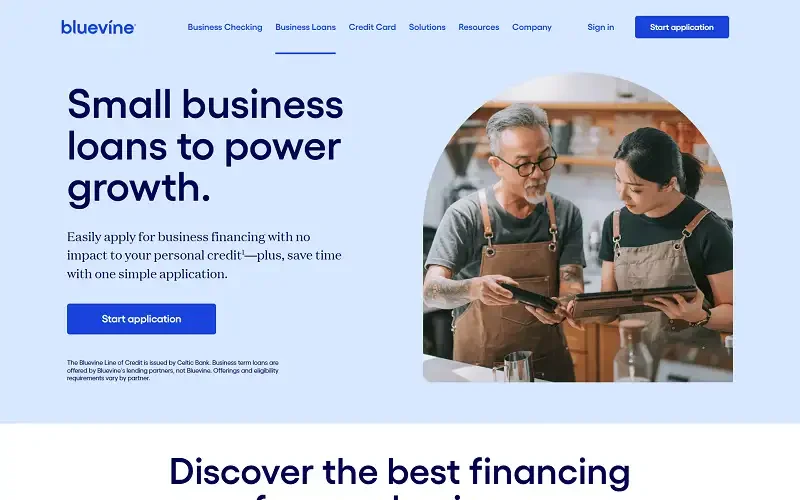

Access to working capital is a major challenge for many small businesses. BlueVine is an online lender that specializes in providing fast, flexible funding options to help companies manage cash flow, cover expenses, and grow. Known for its simplicity and speed, BlueVine has become a popular choice for small business owners who need financing without the lengthy process of traditional banks.

An Overview of BlueVine

Founded in 2013, BlueVine is a financial technology company focused on small business lending and banking. The company offers a variety of funding solutions, including lines of credit, term loans, and invoice factoring, allowing businesses to choose the option that best fits their needs.

BlueVine combines technology-driven approval processes with a customer-centric approach, making access to capital faster and easier.

Funding Options Offered by BlueVine

BlueVine provides several types of financing to meet different business needs:

- Business Lines of Credit – Flexible credit up to $250,000 with interest charged only on funds used.

- Term Loans – Lump-sum financing up to $250,000 with fixed repayment terms.

- Invoice Factoring – Advance up to 90% of unpaid invoices to improve cash flow.

- Business Checking – Online checking accounts with integrated payment solutions for small businesses.

These options give small businesses the flexibility to manage both short-term and long-term financial needs.

How BlueVine Works

BlueVine simplifies borrowing by leveraging online technology to speed up approvals and funding. Business owners start by submitting an online application with basic financial and business information. For lines of credit and term loans, approval can happen within a day, and funds can be deposited shortly after.

Invoice factoring allows businesses to sell unpaid invoices directly to BlueVine and receive cash upfront, improving liquidity without waiting for customers to pay. The platform is designed to be user-friendly and minimize paperwork, making it ideal for busy entrepreneurs.

Who Should Use BlueVine

BlueVine is ideal for:

- Small businesses needing fast access to working capital.

- Companies that want flexible lines of credit for day-to-day operations.

- Businesses with outstanding invoices that want to improve cash flow through factoring.

- Entrepreneurs who prefer online applications and quick funding decisions.

It may not be suitable for companies seeking very large loans or long-term, low-interest financing, which are typically better handled by traditional banks.

Pricing Overview

Pricing at BlueVine varies depending on the product:

- Lines of Credit – Interest rates typically start around 4.8% per month.

- Term Loans – Fixed interest rates based on business risk and loan amount.

- Invoice Factoring – Fees typically range from 0.25% to 1.25% per week of the invoice amount.

All fees and rates are disclosed upfront, allowing borrowers to understand costs before committing.

Why Businesses Choose BlueVine

Businesses choose BlueVine because it provides quick, flexible financing without the cumbersome paperwork of traditional lenders. Whether using a line of credit, a term loan, or invoice factoring, entrepreneurs can get the capital they need to cover payroll, purchase inventory, or seize growth opportunities.

The online platform ensures a fast, transparent process, making it a popular choice for small business owners who need money on short notice.

Pros and Cons of BlueVine

Pros:

- Fast funding, often within 24 hours.

- Flexible financing options including lines of credit and invoice factoring.

- Online platform with minimal paperwork.

- Transparent fees and terms.

- Business checking account option integrated with lending.

Cons:

- Interest rates can be higher than traditional bank loans.

- Limited to U.S.-based businesses.

- Not ideal for long-term, large-scale financing needs.

Final Thoughts

BlueVine stands out as a flexible, fast, and reliable financing solution for small businesses. By offering lines of credit, term loans, and invoice factoring, it allows companies to manage cash flow and respond quickly to business needs. For entrepreneurs looking for convenient and speedy funding, BlueVine provides a modern alternative to traditional bank loans.