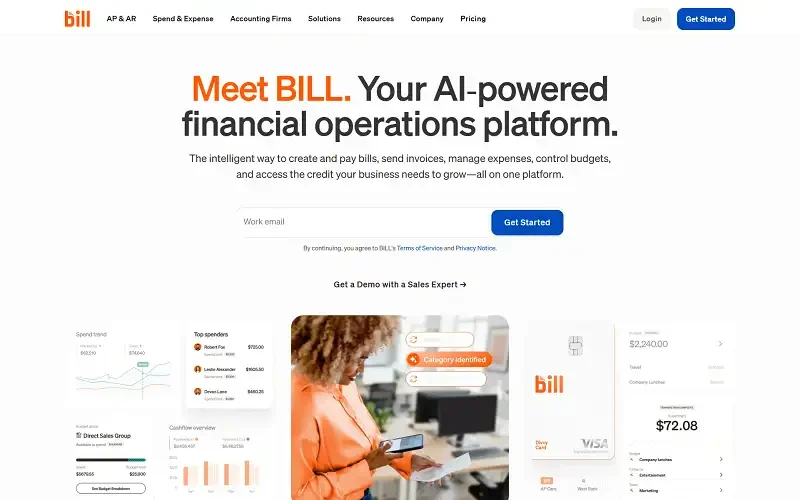

Managing invoices, tracking payments, and reconciling accounts — for many businesses, these tasks can feel endless. But what if you could handle all of it automatically, from one simple dashboard?

That’s the promise of Bill.com, a leading cloud-based platform that transforms how small and medium-sized businesses manage their finances. By automating accounts payable (AP) and accounts receivable (AR), Bill.com helps businesses save time, eliminate errors, and stay cash-flow positive.

Overview of Bill.com

Bill.com is a financial automation platform that simplifies how businesses pay bills, get paid, and manage cash flow. Founded in 2006, it’s now one of the most popular tools among accountants, bookkeepers, and business owners who want to automate financial operations without hiring large finance teams.

With Bill.com, you can receive invoices, approve payments, and send money digitally — all from a secure, cloud-based platform that syncs directly with your accounting software.

In short, it replaces manual paperwork and spreadsheets with a streamlined digital workflow.

Key Features of Bill.com

Bill.com packs in a powerful set of features that cater to businesses of all sizes. Here’s what makes it so valuable:

- Automated Accounts Payable: Approve and pay bills electronically, no paper checks needed.

- Automated Accounts Receivable: Send digital invoices and get paid faster.

- AI-Powered Data Entry: Automatically capture and process invoice details using OCR and machine learning.

- Bank & Accounting Integration: Syncs with QuickBooks, Xero, Sage Intacct, and NetSuite.

- Multi-User Approvals: Set roles, permissions, and approval workflows for team collaboration.

- International Payments: Pay vendors in over 130 countries using multiple currencies.

- Audit Trail & Security: Full visibility into payment history with enterprise-grade security.

These features empower finance teams to manage every transaction from one place — faster and with fewer errors.

How Bill.com Works

Bill.com automates the entire payables and receivables process through a simple, four-step workflow:

- Capture: Upload or receive bills via email or scan. The platform uses OCR technology to extract and enter invoice details automatically.

- Approve: Route bills to the right people for approval — no manual forwarding or signatures required.

- Pay: Once approved, pay vendors electronically by ACH, check, or international transfer.

- Reconcile: Payments automatically sync with your accounting system for easy reconciliation.

On the receivables side, you can create and send invoices directly from Bill.com, track payment status in real time, and receive funds directly into your bank account.

It’s automation that gives you control, visibility, and peace of mind.

Why Businesses Choose Bill.com

Businesses across industries trust Bill.com because it simplifies financial operations and saves valuable time.

Here’s why it’s a top choice for accountants and business owners alike:

- Reduces manual data entry and paper-based tasks.

- Improves accuracy and minimizes payment delays.

- Enhances collaboration with team-based approvals.

- Supports remote work with 100% cloud accessibility.

- Provides better visibility into cash flow and outstanding invoices.

In short, Bill.com turns tedious financial workflows into simple, automated systems that scale with your business.

| Pros | Cons |

| 1. Excellent automation for AP and AR. 2. Seamless integration with major accounting tools. 3. Reduces processing time and errors. 4. Enables international payments. 5. Secure, transparent audit trails. | 1. Learning curve for first-time users. 2. Monthly subscription fees can add up for small startups. |

Bill.com vs. Competitors

Compared to tools like Melio, Tipalti, or QuickBooks Payments, Bill.com offers a more robust and scalable automation system for mid-sized companies and accounting firms.

Melio is great for small businesses needing flexibility, while Tipalti targets global enterprises. Bill.com sits comfortably in between — offering the perfect mix of power, automation, and affordability.

Its deep integrations with accounting platforms and focus on workflow automation make it one of the most complete AP/AR tools available today.

The Future of Financial Automation

As businesses increasingly move toward digital finance, platforms like Bill.com are leading the shift toward paperless, data-driven accounting.

By eliminating manual processes and human errors, Bill.com gives finance teams more control, greater accuracy, and faster payments — essentials in today’s competitive environment.

With continuous innovation in AI and integrations, Bill.com is helping reshape how small businesses handle money — one transaction at a time.

Final Thoughts

Bill.com isn’t just a payment tool — it’s a complete financial workflow system that helps businesses save time, reduce errors, and focus on growth.

Whether you’re managing dozens of vendors or thousands of invoices, Bill.com brings clarity, automation, and efficiency to your financial operations.

For businesses that want to work smarter, not harder — Bill.com delivers.

Now it’s time to check it out — Get Bill.com Now