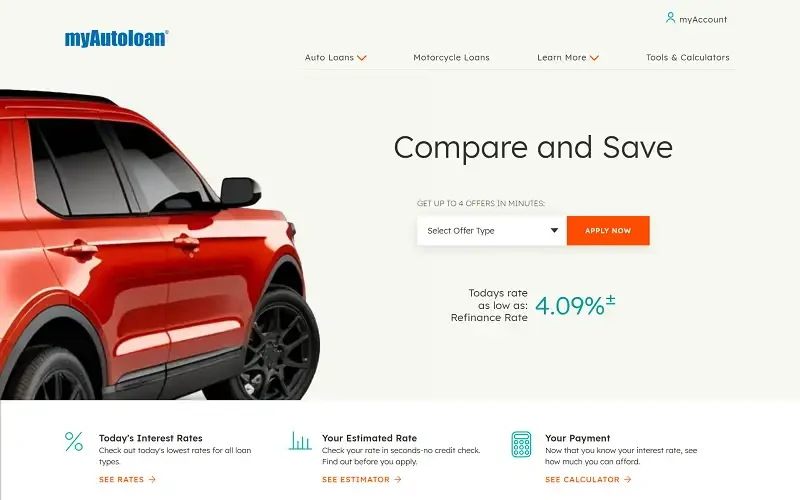

Buying or refinancing a car often means navigating paperwork, credit checks, countless lenders and confusing terms. If you’re looking for a streamlined way to compare auto-loan offers online, myAutoLoan positions itself as a platform to make that process easier. The idea: one application, multiple offers, and less hassle overall.

What is myAutoLoan?

myAutoLoan is a U.S.-based online marketplace (owned by Horizon Digital Finance, LLC and headquartered in Irving, Texas) that connects borrowers with lenders for auto-purchase loans, lease buy-outs, and refinancing of existing auto loans.

The site emphasizes quick, “no-obligation” applications aimed at helping users compare up to four loan offers in minutes. Their stated mission: “Empowering consumers with transparency and choice.”

Key Features of myAutoLoan

Here are some of the notable features of the platform:

- Quick online application: A short offer form that aims to match you with multiple lenders in minutes.

- Multiple offer comparison: After the form you can receive up to four loan offers from participating lenders — giving options for purchase or refinance.

- Used or new vehicle loans, refinance and lease buy-out options: Their loan products cover various use-cases.

- Soft credit check for rate estimate: Preliminary estimates are promoted as “check your rate in seconds — no credit check”.

- Free to apply: No application fees are claimed, and you’re not obligated to accept any specific lender’s offer.

How myAutoLoan Works

Here’s a simplified breakdown of the user journey:

- Visit the myAutoLoan website and start the application, selecting whether you need a purchase, refinance, or lease buy-out.

- Fill out basic details — vehicle type (new/used), your credit profile, income etc.

- Submit the form and be matched with lenders — you’ll receive multiple loan offers to compare.

- Choose the offer that fits your goals (lowest rate, best term, etc.), complete any lender-specific paperwork or credit check.

- Finalize the loan and proceed with purchase, refinance or vehicle acquisition. Note: the marketplace is not the lender — your agreement will be with a lender partner.

Why Borrowers Choose myAutoLoan

Many borrowers consider myAutoLoan because:

- They want to compare loan offers quickly without applying separately to multiple lenders.

- They prefer an online, mostly digital process rather than traditional bank visits.

- They’re looking to refinance a current car loan and may be seeking lower monthly payments or better terms.

- They want to explore lease buy-out options or private-party vehicle purchases that might require broader lender access.

- They appreciate the idea of “no obligation” offers and a platform that claims transparency and choice.

Pros and Cons of myAutoLoan

Pros:

- Application process is simple and digital — good for tech-savvy borrowers.

- You can access multiple lender offers from one form rather than separate applications.

- Covers a variety of loan types: new/used vehicle purchase, refinancing, lease buy-out.

- No upfront application fee and no obligation to accept offers.

- Solid reputation in many reviews; rated well in some independent evaluations.

Cons:

- It is a loan marketplace, not a direct lender — final terms depend on the lender partner.

- Some reviewers report hard credit inquiries or multiple lender contacts after application, which may impact credit score.

Final Thoughts

If you’re in the market for an auto loan or refinance and want to shop multiple offers safely online, myAutoLoan offers a useful platform. Its digital convenience and ability to compare lenders can save you time and simplify your search.

That said, it’s crucial to read the fine print, understand each lender’s terms, check how many credit inquiries may be made, and ensure you’re comparing apples-to-apples (loan amount, vehicle age, term length). For borrowers with strong credit, there may be direct lenders or credit unions that can provide better rates. For those with moderate credit, the marketplace may still be valuable, but you’ll want to proceed thoughtfully.

Transparent. Convenient. But proceed informed. That’s myAutoLoan.

It’s time to check it out — Shop On MyAutoLoan Now