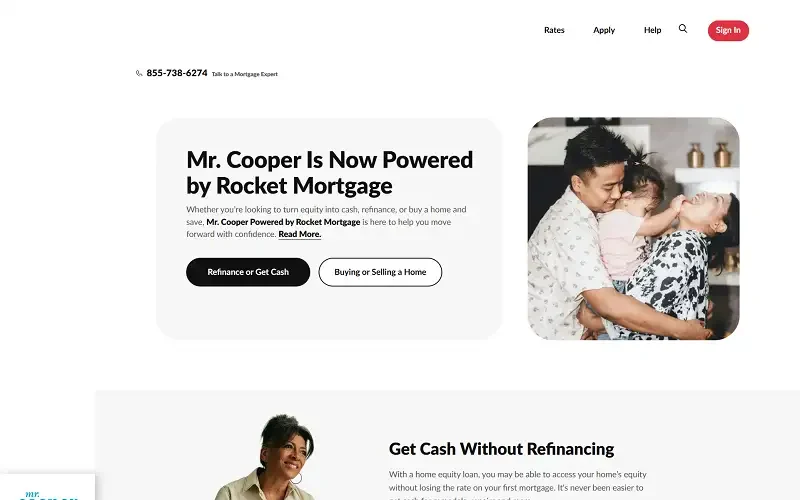

Owning a home is a dream shared by millions, but managing a mortgage can often feel overwhelming. From tracking payments to refinancing or applying for new loans, homeowners crave simplicity and transparency. That’s where Mr. Cooper comes in — a mortgage company that’s built around helping people feel confident, informed, and empowered in their homeownership journey.

As one of the largest mortgage servicers in the United States, Mr. Cooper isn’t just another lender. It’s a company with a mission — to make the mortgage process human, easy, and smart.

What Is Mr. Cooper?

Mr. Cooper (formerly known as Nationstar Mortgage) is a leading mortgage lender and servicer based in the U.S., known for offering home loans, refinancing options, and mortgage servicing for millions of homeowners.

But unlike traditional lenders, Mr. Cooper emphasizes digital convenience and customer care. With its user-friendly online platform, mobile app, and support team, it helps homeowners manage their loans effortlessly, stay informed about refinancing opportunities, and even monitor their home equity.

Key Features of Mr. Cooper

Mr. Cooper offers a wide range of tools and services that simplify homeownership management. Here are some of its standout features:

- Mortgage Loans: A variety of loan options including fixed-rate, adjustable-rate, FHA, and VA loans.

- Refinancing Services: Competitive refinance rates to lower monthly payments or tap into home equity.

- Mobile App: Track payments, view balances, and get personalized insights.

- Home Intelligence Tool: Estimate home value, equity, and explore refinance savings in real-time.

- Payment Assistance: Flexible payment options and hardship support for homeowners facing financial challenges.

- Customer Support: 24/7 access to online tools and responsive service teams.

With these features, Mr. Cooper goes beyond lending — it helps homeowners actively manage and improve their financial health.

How Mr. Cooper Works

Mr. Cooper operates as both a mortgage originator and a servicer, meaning it not only helps you get a loan but also supports you throughout your repayment journey.

Once your loan is approved, you can use the Mr. Cooper app or website to track payments, monitor loan balance, and view your amortization schedule. The platform provides insightful data about your home’s current market value and potential equity, helping you make informed financial decisions.

Additionally, refinancing through Mr. Cooper is made simple — their digital tools allow you to check eligibility, compare options, and submit applications without the usual paperwork headache.

Why Homeowners Choose Mr. Cooper

Homeowners choose Mr. Cooper because it combines technology, transparency, and trust.

It’s not just about getting a mortgage — it’s about making homeownership easier and smarter. With Mr. Cooper, borrowers can:

- Access clear and easy-to-read loan information at any time.

- Explore refinance options tailored to their financial goals.

- Track home equity growth through real-time updates.

- Enjoy friendly, responsive customer service that puts people first.

For many, Mr. Cooper feels less like a bank and more like a helpful partner in their financial journey.

Pros and Cons of Mr. Cooper

Pros:

- Strong digital tools for managing mortgages and refinancing.

- Transparent and user-friendly platform.

- Wide range of home loan and refinance options.

- Personalized insights on home equity and value.

- Helpful customer service with flexible support.

Cons:

- Limited branch locations (mostly online-based).

- Rates and fees may vary depending on credit profile.

- Some users report slower customer response during peak periods.

Mr. Cooper vs. Competitors

Compared to traditional mortgage providers like Rocket Mortgage or Better.com, Mr. Cooper shines with its mortgage servicing excellence. While many lenders focus on originating loans, Mr. Cooper’s real strength lies in helping existing homeowners manage and optimize their mortgages over time.

Its Home Intelligence dashboard and refinance insights set it apart, offering a level of transparency and control most servicers lack.

Final Thoughts

Mr. Cooper represents a modern, people-first approach to mortgages. It’s not just about helping customers buy homes — it’s about helping them manage, protect, and make the most of their biggest investment.

With its mix of technology, service, and simplicity, Mr. Cooper continues to be a trusted partner for millions of homeowners across the U.S.

In a world of complex mortgages, Mr. Cooper makes homeownership simple again.