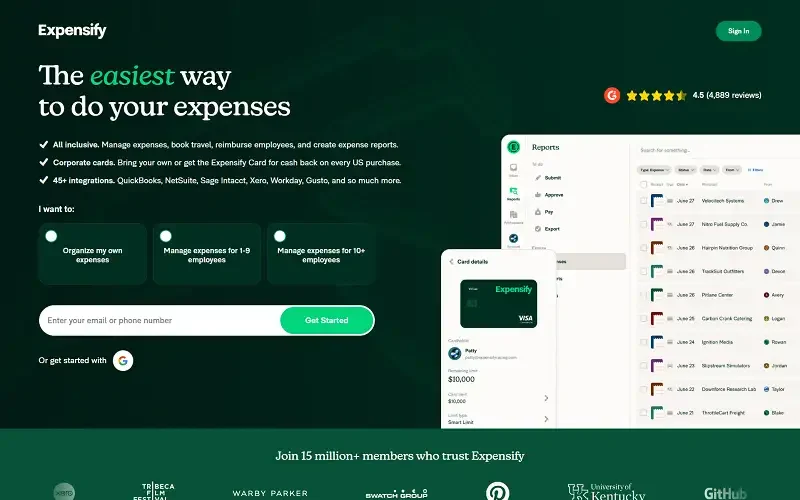

Managing expenses is a critical part of running any business, but it can often feel like a tedious, time-consuming task. Receipts pile up, reimbursements get delayed, and tracking spending becomes a headache. Enter Expensify, a platform designed to simplify expense reporting, automate approvals, and make financial management effortless.

Trusted by millions of professionals worldwide, Expensify transforms the way businesses handle expenses — turning a traditionally cumbersome process into an efficient, transparent, and automated workflow.

What Is Expensify?

Expensify is a cloud-based expense management software that helps businesses track, report, and reimburse expenses with minimal effort. Founded in 2008, Expensify has grown into a leading solution for companies looking to eliminate manual expense reporting and gain better control over spending.

Its mission is simple: to make expense reporting painless for both employees and finance teams. By combining automation with intelligent tools, Expensify reduces errors, speeds up reimbursements, and provides insights into business spending.

Key Features of Expensify

Expensify offers a robust set of features designed to streamline expense management:

- Receipt Scanning: Snap photos of receipts and let Expensify automatically extract the details.

- Automated Expense Reports: Generate reports with minimal manual input.

- Approval Workflows: Customize multi-level approval processes for faster reimbursements.

- Corporate Card Reconciliation: Integrate company credit cards and automatically match transactions.

- Mobile App: Track expenses and approve reports on the go.

- Policy Enforcement: Set rules and limits to ensure compliance.

- Integrations: Sync with accounting software like QuickBooks, Xero, and NetSuite.

With these features, Expensify empowers businesses to control spending, reduce errors, and improve efficiency.

How Expensify Works

Expensify works by centralizing expense tracking into one easy-to-use platform. Employees submit expenses by photographing receipts or importing transactions from linked credit cards. The platform automatically categorizes expenses, matches them to company policies, and generates reports.

Managers can review and approve expenses directly from the dashboard or mobile app. Once approved, reimbursements can be processed quickly, reducing delays and administrative workload.

The platform also provides real-time analytics, allowing finance teams to monitor spending patterns, identify cost-saving opportunities, and maintain compliance effortlessly.

Why Businesses Choose Expensify

Businesses choose Expensify because it eliminates the headaches of manual expense reporting while providing visibility into corporate spending.

It’s particularly valuable for companies that:

- Have employees who travel frequently and need quick reimbursement.

- Want to automate expense reporting and approvals.

- Seek integration with accounting systems for seamless bookkeeping.

- Need policy enforcement and compliance tools.

By streamlining the expense process, Expensify allows companies to save time, reduce errors, and maintain financial control.

Pros and Cons of Expensify

Pros:

- Automatic receipt scanning and expense categorization.

- Mobile app for on-the-go tracking and approvals.

- Customizable workflows and policy enforcement.

- Integrates with popular accounting software.

- Speeds up reimbursements and reduces administrative tasks.

Cons:

- Some advanced features may require higher-tier plans.

- Users may experience a learning curve initially.

- Pricing can be higher for smaller teams with minimal expenses.

Expensify vs. Competitors

Compared to other expense management tools like Certify or Concur, Expensify stands out for its simplicity, automation, and mobile-first approach. While Concur is geared towards large enterprises and complex travel expenses, Expensify is ideal for small-to-medium businesses seeking efficiency without unnecessary complexity.

Final Thoughts

Expensify has transformed expense management by combining automation, mobile accessibility, and intelligent reporting. By reducing manual work and streamlining approvals, it allows businesses to focus on growth while keeping spending under control.

For companies that want to simplify expense reporting, speed up reimbursements, and gain better visibility into spending, Expensify is a reliable, modern solution.

Efficient. Automated. Insightful. That’s Expensify.