In a world where traditional banking feels outdated and slow, SoFi has emerged as a modern alternative — built for today’s digital generation. Whether you’re refinancing student loans, looking for a mortgage, or simply trying to grow your money, SoFi brings everything under one roof with speed, simplicity, and smart technology.

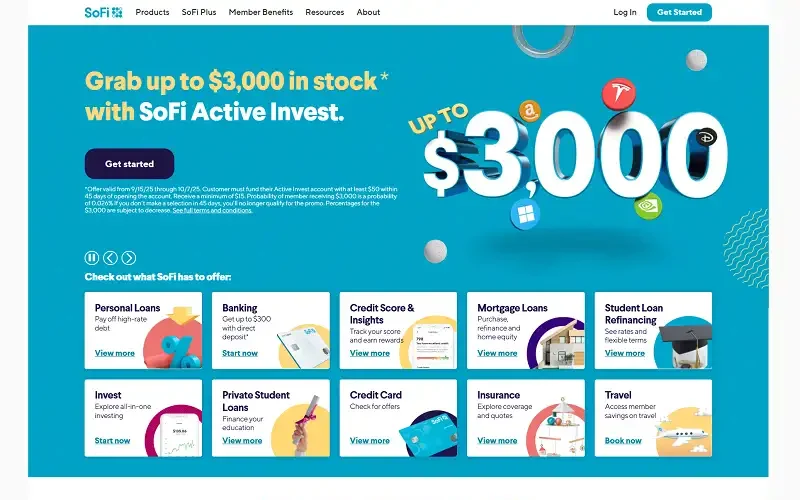

Since its founding in 2011, SoFi (short for Social Finance) has grown from a small student loan refinancing company into a full-fledged financial ecosystem serving millions of members. Today, it offers everything from personal loans and credit cards to investing, banking, and insurance — all accessible through a single, beautifully designed mobile app.

What Is SoFi?

SoFi is an American online personal finance company and digital bank that provides a wide range of financial products — including loans, banking, investing, and insurance. The platform aims to help individuals “get their money right,” combining powerful technology with personalized financial tools.

Unlike traditional banks, SoFi eliminates unnecessary fees, simplifies approval processes, and helps customers build wealth through automation and education.

Key Features of SoFi

SoFi’s ecosystem is designed to make managing money effortless and rewarding. Some of its standout features include:

- Personal Loans: Competitive fixed rates, no hidden fees, and flexible repayment options.

- Student Loan Refinancing: Lower your interest rate and simplify monthly payments.

- SoFi Checking & Savings: Earn high interest rates and enjoy fee-free banking.

- SoFi Invest: Buy stocks, ETFs, and crypto with no commission fees.

- SoFi Credit Card: Get cash back and earn rewards for smart spending.

- Home Loans & Mortgages: Streamlined application process with fast approval.

- Financial Tools & Education: Access financial planning tools, budgeting tips, and career coaching.

SoFi isn’t just about borrowing money — it’s about helping people achieve long-term financial growth.

How SoFi Works

The SoFi platform operates entirely online through its app and website, giving users full control over their finances anytime, anywhere.

When you apply for a loan, the system uses intelligent underwriting to assess eligibility quickly — often providing instant approval decisions. If you’re using SoFi for banking, your deposits are insured, and your funds can earn higher-than-average interest rates without monthly maintenance fees.

With SoFi Invest, you can automate investments or trade manually, while SoFi Relay helps you track your spending and credit score in real time.

In short — SoFi puts the entire financial picture of your life into one seamless dashboard.

Why People Choose SoFi

People choose SoFi because it combines the best features of traditional banking and modern fintech innovation. It offers personalized solutions for borrowers, savers, and investors alike — all while keeping costs low and convenience high.

SoFi also provides something few banks offer: a genuine community. Members enjoy career services, exclusive events, and financial education resources that go beyond basic banking.

For millennials and Gen Z professionals who prefer mobile-first financial freedom, SoFi feels less like a bank and more like a financial partner.

Pros and Cons of SoFi

Pros:

- Wide range of financial products under one platform.

- No account fees or hidden charges.

- Competitive interest rates for loans and savings.

- Excellent mobile app and user-friendly experience.

- Free access to financial planning and career coaching.

Cons:

- Some loan types require higher credit scores.

- Limited physical branches for in-person support.

- Not ideal for people who prefer traditional banking interactions.

Final Thoughts

SoFi has redefined what it means to manage money in the modern world. It’s fast, transparent, and built around helping users grow — not just transact. Whether you’re consolidating debt, investing for the future, or simply looking for a smarter way to bank, SoFi delivers an all-in-one solution that truly puts you in control.

With SoFi, financial success isn’t just a dream — it’s a lifestyle.