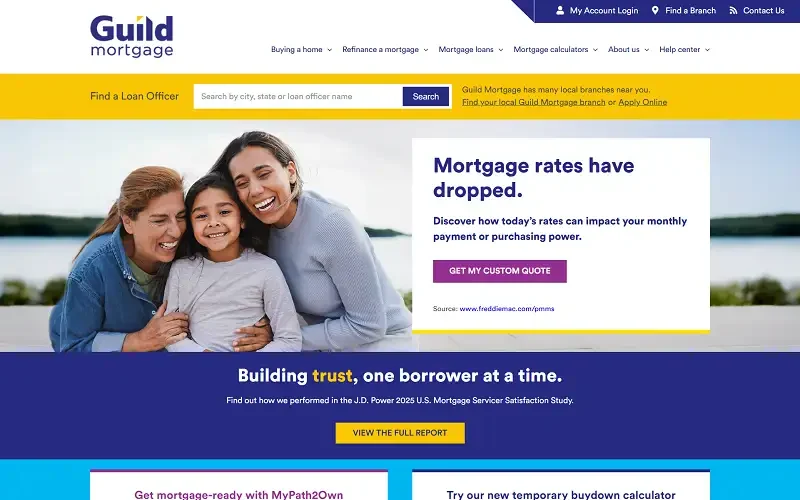

When it comes to buying a home, borrowers often look for more than just competitive rates — they want a lender that understands their needs and offers guidance every step of the way. Guild Mortgage has built its reputation on providing personalized, community-based lending services that make the dream of homeownership more accessible to millions of Americans.

An Overview of Guild Mortgage

Founded in 1960, Guild Mortgage is one of the oldest independent mortgage lenders in the United States. Headquartered in San Diego, California, the company has decades of experience helping families buy, refinance, and renovate their homes. Unlike many online-only lenders, Guild takes a relationship-driven approach, focusing on personalized service through local branches and knowledgeable loan officers.With its mix of technology, personal support, and wide loan options, Guild Mortgage offers borrowers both convenience and confidence.

Loan Options Offered by Guild Mortgage

Guild Mortgage provides a comprehensive range of loan products tailored to different financial situations:

- Conventional Loans – Fixed and adjustable-rate loans for standard homebuyers.

- FHA Loans – Government-backed options for those with lower credit scores or smaller down payments.

- VA Loans – Designed for veterans, active military, and eligible family members.

- USDA Loans – For rural and suburban homebuyers seeking low or no down payments.

- Jumbo Loans – For luxury or higher-value homes exceeding standard loan limits.

- Renovation & Refinance Loans – Options for homeowners looking to upgrade or lower their interest rates.

This variety makes Guild Mortgage suitable for both first-time homebuyers and experienced property owners.

How Guild Mortgage Works

Guild Mortgage combines personalized service with digital convenience. Borrowers can begin their mortgage journey online or at a local branch. After completing a pre-approval application, Guild’s loan officers guide customers through loan selection, documentation, and underwriting.

The company’s digital platform, MyMortgage, allows users to upload documents, check loan status, and communicate with their loan officer in real time. This hybrid model — part traditional, part tech-driven — ensures a smooth experience for borrowers who value human connection without sacrificing speed or transparency.

Who Should Use Guild Mortgage

Guild Mortgage is ideal for:

- First-time homebuyers looking for personal guidance.

- Military members and veterans seeking VA loans.

- Borrowers in rural or suburban areas interested in USDA loans.

- Homeowners looking to refinance or renovate.

- Buyers who prefer local service over a fully online process.

It may not be the perfect fit for borrowers who want an entirely digital, self-service mortgage experience.

Pricing and Rates

Guild Mortgage’s rates vary depending on the loan type, borrower profile, and market trends. Generally:

- Rates are competitive with other major lenders.

- Closing costs are clearly disclosed upfront.

- Pre-approval gives borrowers an estimate of loan terms before committing.

Borrowers can apply online or speak with a local branch for a personalized quote and rate comparison.

Why Homebuyers Choose Guild Mortgage

Many borrowers choose Guild Mortgage for its commitment to customer relationships and local expertise. The company prioritizes fast communication, clear loan explanations, and tailored solutions. Unlike lenders that rely solely on algorithms, Guild loan officers take time to understand each borrower’s story — whether it’s a young family buying their first home or a veteran refinancing to save on monthly payments.

Their community-driven approach helps make home financing feel less intimidating and more personal.

Pros and Cons of Guild Mortgage

Pros:

- Wide range of loan options including FHA, VA, USDA, and Jumbo.

- Strong reputation and decades of experience.

- Personalized customer service through local branches.

- Smooth online platform with digital document uploads.

- Excellent for first-time and veteran homebuyers.

Cons:

- Limited online-only experience (requires more personal contact).

- Rates may vary slightly by region or branch.

- Fewer options for borrowers outside the U.S.

Final Thoughts

Guild Mortgage blends the best of both worlds — personalized service and modern convenience. With its long-standing reputation, variety of loan products, and community focus, it remains a top choice for borrowers seeking a more human approach to home financing.

For anyone who values guidance, clarity, and trusted local expertise, Guild Mortgage stands out as one of America’s most dependable home lenders.